Executive Benchmarking Best Practices

**Executive Benchmarking Best Practices**

By Remunera Team • 2025-10-27 •

Executive Benchmarking Best Practices

Turning Market Data into Strategic Remuneration Decisions

In today’s environment, executive remuneration benchmarking is no longer just about comparing numbers, it’s about aligning pay with purpose, governance, and performance. Boards, investors, and regulators expect decisions that are fair, transparent, and strategically grounded.

Yet, many organisations still treat benchmarking as a one-off data exercise rather than a decision-support process. When executed properly, benchmarking can clarify your pay positioning, reveal hidden risks, and strengthen your ability to attract and retain senior talent.

Below are key best practices to ensure your executive benchmarking delivers meaningful outcomes, not just spreadsheets.

1. Start with Clear Intent

Benchmarking should begin with why, not what.

Boards need clarity on the purpose of the exercise, is it to test competitiveness, prepare for an IPO, address retention risk, or review incentive mix?

A defined purpose shapes everything else: peer selection, market sources, percentile positioning, and the depth of analysis. Without it, benchmarking can easily drift into data-gathering rather than decision-making.

2. Define the Right Peer Group

The peer group is the cornerstone of valid benchmarking. The most common mistake is over-reliance on industry peers only.

Instead, peer groups should reflect:

- Business size and complexity: revenue, market capitalisation, headcount, and geographic footprint

- Operating model: capital intensity, risk profile, or customer type

- Talent market: where you compete for executives, not just where you compete for customers

For many mid-size organisations, a mix of industry-specific and size-based peers produces the most relevant insight.

3. Benchmark by Role Scope, Not Title

Job titles at executive level often vary widely. A “Chief Commercial Officer” in one company might oversee 500 staff and multiple P&Ls, while in another, the role could focus purely on partnerships.

Effective benchmarking starts with role evaluation, not title matching. Tools such as Hay job evaluation or similar frameworks can quantify the size and complexity of each role. Matching by scope, accountability, and decision rights ensures you’re comparing like-for-like data.

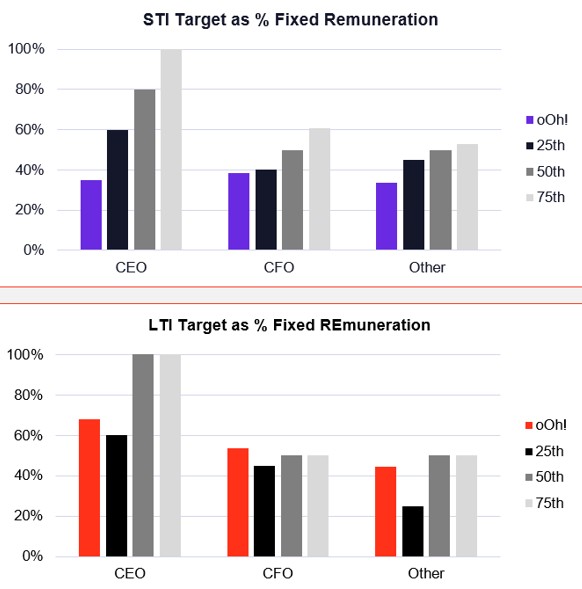

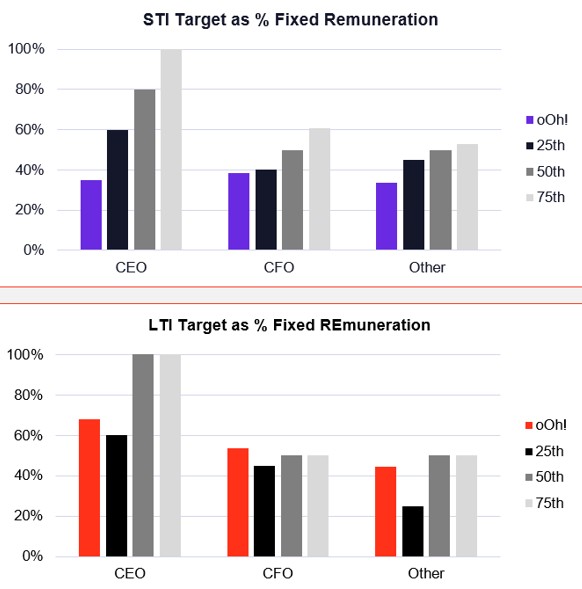

4. Focus on Total Reward, Not Just Fixed Pay

Benchmarking only fixed remuneration tells half the story.

The real insight lies in the total reward structure, the balance between:

- Fixed remuneration (base salary, superannuation, benefits)

- Short-term incentives (STI)

- Long-term incentives (LTI or equity)

Analysing the mix of fixed vs. variable pay provides context around risk appetite, performance alignment, and competitiveness. A strong pay mix story also supports clearer board and shareholder communication.

5. Understand Market Positioning and Percentiles

Australian market practice typically targets the 50th percentile (market median) for total reward. However, strategic variations may apply:

- 25th–50th percentile: for developing roles or stable markets

- 50th–75th percentile: for critical, scarce, or high-performing talent Boards should also monitor internal equity, ensuring CEO-to-executive pay ratios remain reasonable and consistent with governance expectations.

6. Look Beyond Data, Interpret Context

Market data alone doesn’t tell you why pay levels differ. True benchmarking blends quantitative analysis with qualitative insight:

- Business performance relative to peers

- Tenure, experience, and succession pipeline

- Organisational lifecycle (growth, transformation, turnaround)

This interpretive layer transforms benchmarking from a compliance task into a strategic board tool.

7. Incorporate Governance and Investor Expectations

Proxy advisers, regulators, and institutional investors have growing influence on executive pay design.

Benchmarking must be conducted through a governance lens, ensuring:

- Transparency in peer group selection

- Defensible rationale for pay movements

- Alignment of incentives with shareholder outcomes

Boards that integrate these elements proactively reduce the risk of investor pushback or negative AGM outcomes.

8. Revisit Regularly

The executive market shifts rapidly, particularly in high-growth and technology sectors.

Best practice is to conduct a full benchmarking review every two years, with lighter market check-ins annually. This ensures pay decisions remain current and responsive to evolving market conditions and internal structures.

9. Communicate Findings Transparently

Benchmarking insights should flow beyond the remuneration committee. Summarised outcomes — positioned carefully — can strengthen executive trust and transparency.

Executives are more likely to engage constructively in pay discussions when they understand the rationale behind board decisions.

10. Use Benchmarking as a Foundation for Strategy

Finally, benchmarking should not be the conclusion — it should be the starting point for broader remuneration strategy.

Insights can inform:

- Pay mix redesigns

- Incentive plan calibration

- Retention and succession strategies

- EVP and broader employee value proposition alignment

The goal is not just to match the market — but to create a distinct, defensible, and strategically aligned remuneration framework.

Final Thought

Executive benchmarking is as much an art as it is a science.

The best outcomes come when rigorous data is balanced with informed judgment, stakeholder context, and strategic foresight.

Boards that approach benchmarking with this mindset gain more than pay insights — they gain a clearer picture of leadership value, performance alignment, and organisational readiness for the future.

Remunera Team

Tags

Stay Informed

Get the latest insights on compensation management, salary benchmarking, and HR analytics delivered directly to your inbox.

✓ Weekly expert insights

✓ Industry trend analysis

✓ Best practice guides